Recent Articles from MarketMinute

MarketMinute is a dynamic online platform dedicated to delivering real-time stock news and market insights to investors and enthusiasts alike. Operated by FinancialContent, a leading digital publisher in financial news, the website offers up-to-the-minute updates on stock movements, corporate earnings, analyst ratings, and macroeconomic trends that shape the financial landscape.

Website: https://www.marketminute.com

In a dramatic reversal of fortune for the beleaguered electric vehicle sector, Polestar Automotive Holding UK PLC (NASDAQ: PSNY) saw its shares skyrocket by nearly 32% on Friday, February 6, 2026. The surge, which propelled the stock to a closing price of $19.42, marks the company’s most significant

Via MarketMinute · February 9, 2026

The first full week of February 2026 will be remembered by traders as the "SaaSpocalypse"—a brutal, high-velocity whipsaw that redefined the boundaries of the artificial intelligence trade and tested the resilience of the digital-asset ecosystem. In a span of just five trading days, the market grappled with a fundamental

Via MarketMinute · February 9, 2026

DENVER – In a dramatic reversal of fortune that has stunned Wall Street, Lumen Technologies (NYSE:LUMN) saw its stock price skyrocket by 29.4% on Friday, February 6, 2026. The surge, which propelled the stock to a closing price of $8.06, marks a definitive technical breakout for the telecommunications

Via MarketMinute · February 9, 2026

As the S&P 500 (INDEXSP: .INX) pushes toward the 7,100 mark in early 2026, a growing chorus of investors is nervously glancing back at the ghosts of 1999. With the index having notched double-digit gains in 2025, driven by the relentless expansion of artificial intelligence and high-cap technology

Via MarketMinute · February 9, 2026

The digital asset landscape witnessed a seismic shift this week as Bullish (NYSE: BLSH), the institutional-grade crypto exchange, reported an explosive 70% year-over-year revenue growth in its latest quarterly earnings. Propelled by the meteoric rise of its newly launched options trading platform and a calculated expansion into the United States,

Via MarketMinute · February 9, 2026

In a week that has redefined expectations for the North American energy sector, Marathon Petroleum (NYSE: MPC) has delivered a masterclass in operational efficiency. Following its Q4 2025 earnings release on February 3, 2026, the company sent ripples through the financial markets by reporting an adjusted earnings per share (EPS)

Via MarketMinute · February 9, 2026

Following a robust fourth-quarter earnings report that exceeded analyst expectations, Verizon Communications Inc. (NYSE: VZ) has seen its stock price climb to heights not witnessed in years. The telecommunications giant, long viewed as a stodgy utility-like play for income seekers, signaled a major strategic shift on January 30, 2026, announcing

Via MarketMinute · February 9, 2026

Snap Inc. (NYSE: SNAP) has finally delivered what Wall Street has demanded for years: consistent profitability. In its Q4 2025 earnings report released on February 4, 2026, the social media pioneer revealed a business model that is rapidly maturing, driven by the explosive growth of its subscription service, Snapchat+, and

Via MarketMinute · February 9, 2026

The dawn of 2026 has brought a chilling realization to Silicon Valley and Wall Street alike: the very software giants that spent two decades disrupting legacy industries are now being disrupted themselves. In what is being termed the "Big 2026 Sector Rotation," investors are aggressively pulling capital out of traditional

Via MarketMinute · February 9, 2026

With the era of Jerome Powell rapidly approaching its sunset, the financial world is grappling with a potential "regime change" that could fundamentally alter the relationship between the Federal Reserve, the economy, and the stock market. The recent nomination of Kevin Warsh to succeed Powell as Chair of the Board

Via MarketMinute · February 9, 2026

Global energy markets experienced a seismic shift this week as crude oil prices plummeted by more than 5%, effectively wiping out the "war premium" that had defined the start of the year. The sudden decline was triggered by a dual-pronged catalyst: a significant diplomatic de-escalation between the United States and

Via MarketMinute · February 9, 2026

The second week of February 2026 has arrived with a sense of urgency rarely seen in recent financial history. Following a brief but disruptive partial government shutdown that paralyzed data collection in January, Wall Street is now bracing for a "macroeconomic crescendo." This week, investors are confronting a compressed calendar

Via MarketMinute · February 9, 2026

The meteoric rise of telehealth giant Hims & Hers Health (NYSE: HIMS) faced its most severe reckoning this week, as the company’s stock plummeted to a one-year low following a dramatic withdrawal of its highly anticipated oral weight-loss treatment. What was intended to be a disruptive move against the pharmaceutical

Via MarketMinute · February 9, 2026

The first week of February 2026 has proven to be a sobering reality check for equity markets, as the long-standing euphoria surrounding artificial intelligence (AI) collided with the stark financial reality of its implementation. While the S&P 500 (^GSPC) managed to claw back some losses to close near 6,

Via MarketMinute · February 9, 2026

As the financial world pivots into the first quarter of 2026, all eyes are on Ares Management (NYSE: ARES) as it prepares to pull back the curtain on its fourth-quarter and full-year 2025 performance. This earnings cycle is widely viewed as a litmus test for the "private credit boom" that

Via MarketMinute · February 9, 2026

CAMBRIDGE, UK — In a market once defined by its dominance in the pockets of billions, Arm Holdings (NASDAQ: ARM) has officially completed its migration from the palm of the hand to the heart of the cloud. Following its third-quarter fiscal 2026 earnings report on February 6, the British chip designer

Via MarketMinute · February 9, 2026

Tesla, Inc. (NASDAQ: TSLA) finds itself at a defining moment in its corporate history following the release of its Q4 2025 earnings report. As of February 9, 2026, the market is grappling with a paradox: Tesla’s core automotive deliveries fell by roughly 9% in 2025, yet its stock price

Via MarketMinute · February 9, 2026

Following its Q2 FY2026 earnings release on January 28, Microsoft Corp (NASDAQ: MSFT) finds itself at a historic crossroads. Despite delivering a "double beat" on both revenue and earnings, the tech giant’s stock price has undergone a significant correction in early February, sliding nearly 14% as investors grapple with

Via MarketMinute · February 9, 2026

In a move that has recalibrated the scale of the global technology arms race, Amazon.com, Inc. (NASDAQ:AMZN) stunned Wall Street this week by announcing a massive $200 billion capital expenditure guidance for 2026. This unprecedented figure, aimed squarely at securing dominance in generative AI and satellite infrastructure, represents

Via MarketMinute · February 9, 2026

As of February 9, 2026, Apple Inc. (NASDAQ: AAPL) has once again solidified its position as the bellwether of the technology sector, navigating a volatile market to push its valuation toward the historic $4 trillion milestone. Following a blockbuster fiscal fourth-quarter 2025 earnings report and a robust follow-through in its

Via MarketMinute · February 9, 2026

The global financial landscape was upended on February 6, 2026, as the precious metals market witnessed a "6-sigma" volatility event that defied centuries of historical correlation. In a session characterized by pure atmospheric chaos, silver prices skyrocketed to an unprecedented $78 per ounce, while gold, the traditional safe-haven anchor, suffered

Via MarketMinute · February 6, 2026

In a stunning display of market resilience, "crypto proxy" stocks led a massive broad-based rally on February 6, 2026, as digital asset prices staged a dramatic "V-shaped" recovery. Leading the charge, Robinhood Markets, Inc. (NASDAQ: HOOD) saw its shares climb by more than 14%, while Coinbase Global, Inc. (NASDAQ: COIN)

Via MarketMinute · February 6, 2026

Evercore (NYSE: EVR), a powerhouse in the independent advisory sector, released its fourth-quarter and full-year 2025 earnings this week, providing the most definitive evidence yet of a "V-shaped" recovery in global mergers and acquisitions. Following two years of relative stagnation, the firm reported record-breaking revenue and an unprecedented backlog of

Via MarketMinute · February 6, 2026

In a staggering blow to the cosmetics industry, Coty Inc. (NYSE: COTY) saw its shares retreat by 16% today, February 6, 2026, marking the company’s steepest single-day decline in years. The sell-off followed a disappointing second-quarter fiscal 2026 earnings report that laid bare the intensifying challenges facing the beauty

Via MarketMinute · February 6, 2026

The digital healthcare landscape faced a harsh reality check on February 6, 2026, as shares of Doximity, Inc. (NYSE: DOCS) plummeted 17% in early trading. Despite reporting fiscal third-quarter results that surpassed analyst estimates for both revenue and earnings, the professional network for physicians issued a tepid outlook for the

Via MarketMinute · February 6, 2026

SAN DIEGO — Shares of Qualcomm Inc. (NASDAQ: QCOM) experienced a sharp sell-off this week, falling over 10% after the semiconductor giant issued a sobering second-quarter forecast that overshadowed record-breaking first-quarter results. Despite surpassing analyst expectations for the end of 2025, management warned that a structural "memory crunch" is beginning to

Via MarketMinute · February 6, 2026

The digital landscape witnessed a seismic shift on February 6, 2026, as shares of Roblox (NYSE: RBLX) soared more than 10% in early trading following a blockbuster fourth-quarter earnings report. The company, once viewed primarily as a playground for children, proved to Wall Street that its transition into a multi-generational

Via MarketMinute · February 6, 2026

BILL Holdings (NYSE: BILL) saw its shares skyrocket by more than 14% in early trading on February 6, 2026, as investors cheered a robust second-quarter fiscal 2026 earnings report that exceeded expectations across every major financial metric. The San Jose-based financial automation leader delivered a "beat and raise" quarter, characterized

Via MarketMinute · February 6, 2026

In a dramatic reversal of fortune for the digital asset sector, MicroStrategy Inc. (NASDAQ: MSTR) spearheaded a massive rally on the Nasdaq today, February 6, 2026, with its stock price surging 25%. The leap comes as Bitcoin (BTC) staged a historic "V-shaped" recovery, rebounding from a harrowing intraday low of

Via MarketMinute · February 6, 2026

Eli Lilly and Company (NYSE: LLY) has officially entered the "trillion-dollar club" with a roar, issuing a blockbuster financial guidance for 2026 that projects revenue between $80 billion and $83 billion. The announcement, made during the company’s early February earnings call, marks a historic turning point in the pharmaceutical

Via MarketMinute · February 6, 2026

In a move that has sent shockwaves through Silicon Valley and Wall Street alike, Alphabet Inc. (NASDAQ: GOOGL) has unveiled a staggering capital expenditure outlook for 2026, signaling its intent to lead the next era of computing at any cost. Following its Q4 2025 earnings report, the tech giant announced

Via MarketMinute · February 6, 2026

In a stunning reversal of a year-long industrial malaise, the U.S. manufacturing sector roared back to life this week as the Institute for Supply Management (ISM) released its latest Purchasing Managers' Index (PMI) data. The report, made public on February 6, 2026, showed the manufacturing PMI climbing to a

Via MarketMinute · February 6, 2026

The global financial landscape was upended this week following the announcement that Kevin Warsh, a former Federal Reserve Governor known for his skeptical stance on unconventional monetary policy, has been nominated to succeed Jerome Powell as the next Chair of the Federal Reserve. The news, which broke on the morning

Via MarketMinute · February 6, 2026

The managed care sector was sent into a tailspin on Friday as Molina Healthcare (NYSE: MOH) saw its market capitalization evaporate in a historic sell-off. Shares of the Long Beach-based insurer plummeted 28% to $127.16 after the company issued a 2026 earnings forecast that was not just a miss,

Via MarketMinute · February 6, 2026

In a breathtaking display of the digital asset market's enduring volatility, Bitcoin (BTC) staged a massive "V-shaped" recovery on February 6, 2026, surging back above the $70,000 psychological threshold. This rally followed a harrowing overnight session where the world's largest cryptocurrency plummeted to an intraday low of $60,008.

Via MarketMinute · February 6, 2026

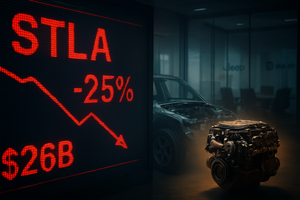

The global automotive landscape was jolted on February 6, 2026, as Stellantis N.V. (NYSE: STLA) saw its shares plummet by 25% following the announcement of a massive €22.2 billion ($26 billion) one-time charge. The staggering write-down is the cornerstone of a radical "business reset" orchestrated by new leadership

Via MarketMinute · February 6, 2026

OMAHA, NE and ATLANTA, GA — In a move that has sent shockwaves through the global logistics industry and ignited a firestorm of regulatory scrutiny, Union Pacific (NYSE:UNP) and Norfolk Southern (NYSE:NSC) are aggressively pursuing a historic $85 billion merger. The deal, which aims to create the first truly

Via MarketMinute · February 6, 2026

SEATTLE — Shares of Amazon.com, Inc. (NASDAQ:AMZN) plummeted more than 5% in early trading on Friday, February 6, 2026, following a fourth-quarter earnings report that showcased record-breaking revenue but also unveiled a staggering $200 billion capital expenditure plan for the coming year. While the tech giant beat analyst expectations

Via MarketMinute · February 6, 2026

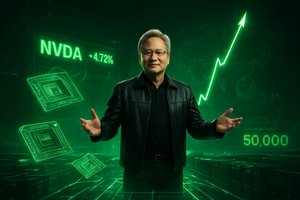

In a historic session for Wall Street, shares of Nvidia (NASDAQ:NVDA) surged more than 8% on Friday, February 6, 2026, breathing new life into the global technology trade. The rally was ignited by a high-stakes television appearance by CEO Jensen Huang, who declared that the demand for artificial intelligence

Via MarketMinute · February 6, 2026

In a historic display of market resilience and technological optimism, the Dow Jones Industrial Average closed above the 50,000-point milestone for the first time in history on Friday, February 6, 2026. The blue-chip index surged by a staggering 1,200 points during the session, ending the day at 50,

Via MarketMinute · February 6, 2026

As the global automotive industry navigates a volatile transition toward electrification, Ford Motor Company (NYSE: F) finds itself at a defining crossroads. The Dearborn-based automaker is scheduled to release its fourth-quarter 2025 financial results on February 10, 2026, with Wall Street analysts laser-focused on a consensus earnings-per-share (EPS) estimate of

Via MarketMinute · February 6, 2026

Biogen Inc. (NASDAQ: BIIB) reported its fourth-quarter and full-year 2025 financial results on February 6, 2026, signaling a definitive shift from a legacy company plagued by patent cliffs to a leaner, growth-oriented neurology powerhouse. Despite a 7% year-over-year revenue decline to $2.28 billion, the company beat Wall Street expectations

Via MarketMinute · February 6, 2026

The geopolitical landscape was rocked in early 2026 by the so-called "Greenland Episode," a diplomatic and economic confrontation that has pushed the relationship between the United States and the European Union to its lowest point in decades. What began as a renewed U.S. strategic interest in the Arctic territory

Via MarketMinute · February 6, 2026

MUSCAT, Oman — On February 6, 2026, global financial markets pivoted sharply as indirect negotiations between the United States and Iran resumed in Oman, aiming to de-escalate a year of unprecedented military and economic friction. This "Oman Round" of talks comes on the heels of a historic surge in gold prices

Via MarketMinute · February 6, 2026

In a week defined by high-stakes political theater and a brief but disruptive lapse in federal operations, Washington has managed to pull back from the edge of a total collapse—though only partially. On February 3, 2026, a $1.2 trillion appropriations package was signed into law, ending a four-day

Via MarketMinute · February 6, 2026

As of February 6, 2026, the dominant narrative on Wall Street has shifted from the virtual to the tangible. After years of dominance by Silicon Valley’s software giants, a powerful "Great Rotation" is underway, with institutional capital aggressively migrating toward the backbone of the physical economy. Investors are increasingly

Via MarketMinute · February 6, 2026

The optimistic start to 2026 has been abruptly halted as the S&P 500 index officially turned red for the year during a volatile trading session on February 6, 2026. After a promising January that saw the index climb 1.4%, a brutal three-day rout has wiped out nearly $1

Via MarketMinute · February 6, 2026

The United States labor market, long considered the resilient backbone of the post-pandemic economy, showed significant signs of strain in January 2026. A dual-threat of surging corporate layoffs and a sharp contraction in job openings has sent ripples through the financial markets, challenging the "soft landing" narrative that dominated much

Via MarketMinute · February 6, 2026

The enterprise software sector is currently weathering its most severe valuation crisis in over two decades, as investors aggressively reappraise the future of software-as-a-service (SaaS) in an era dominated by autonomous AI. As of February 6, 2026, the industry’s average forward price-to-earnings (P/E) ratio has plummeted to roughly

Via MarketMinute · February 6, 2026

In a decisive move that underscores the unexpected resilience of the American economy, the Federal Reserve announced last week it would maintain the federal funds rate in the 3.5% to 3.75% range. This "hawkish hold" marks a pivotal pause in the easing cycle that dominated late 2025, signaling

Via MarketMinute · February 6, 2026

In a move that has sent shockwaves through global financial markets, the nomination of Kevin Warsh to succeed Jerome Powell as the Chair of the Federal Reserve has signaled a dramatic regime shift in American monetary policy. Announced on January 30, 2026, the decision marks the end of the "Powell

Via MarketMinute · February 6, 2026

Advanced Micro Devices (NASDAQ: AMD) has delivered a resounding statement to the semiconductor industry, reporting fourth-quarter 2025 earnings that shattered analyst expectations and signaled a massive shift in the landscape of artificial intelligence infrastructure. The chipmaker posted non-GAAP earnings of $1.53 per share, representing a blistering 40% year-over-year jump

Via MarketMinute · February 6, 2026

In a dramatic shift for the consumer staples sector, The Hershey Company (NYSE: HSY) saw its stock price climb more than 9% following the release of its fourth-quarter 2025 earnings report. The confectionery giant not only shattered analyst expectations for both profit and revenue but also provided a surprisingly robust

Via MarketMinute · February 6, 2026

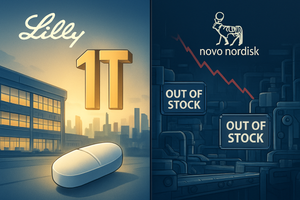

The long-standing duopoly of the weight-loss drug market faced its most significant challenge yet this week as Hims & Hers Health, Inc. (NYSE: HIMS) announced a breakthrough $49 compounded oral semaglutide pill. The move, aimed directly at the market share of pharmaceutical titans Eli Lilly and Company (NYSE: LLY) and Novo

Via MarketMinute · February 6, 2026

AMSTERDAM — In a day of unprecedented volatility for the global automotive sector, Stellantis NV (NYSE: STLA) saw its stock price crater by more than 24% on Friday, February 6, 2026. The collapse followed a grim financial disclosure in which the world’s fourth-largest automaker announced a staggering €22.2 billion

Via MarketMinute · February 6, 2026

[ one to two paragraphs describing the current event and its immediate implications ]

The American industrial landscape is currently witnessing its most significant upheaval in decades as Union Pacific (NYSE: UNP) continues its aggressive $85 billion pursuit of Norfolk Southern (NYSE: NSC). This historic bid, which aims to create the first

Via MarketMinute · February 6, 2026

In the high-stakes arena of Silicon Valley, the honeymoon period for artificial intelligence is officially over. As Alphabet Inc. (NASDAQ: GOOGL) steps into the spotlight for its latest earnings cycle on February 6, 2026, the tech giant finds itself at a precarious crossroads. While the company continues to mint billions

Via MarketMinute · February 6, 2026

Amazon.com Inc. (NASDAQ: AMZN) shares suffered their steepest one-day decline in nearly two years on Friday, February 6, 2026, after the e-commerce and cloud titan unveiled a capital expenditure (capex) forecast that stunned even the most aggressive Wall Street analysts. Despite reporting record-breaking revenue of $213.4 billion for

Via MarketMinute · February 6, 2026

On January 28, 2026, Microsoft Corp. (NASDAQ: MSFT) released its calendar year-end financial results, delivering a performance that, on paper, should have been a triumph. The tech giant reported record quarterly revenue of $81.3 billion and earnings per share of $4.14, handily beating analyst estimates. However, the market’

Via MarketMinute · February 6, 2026

In a definitive signal that the investment banking winter has not only thawed but shifted into a high-intensity burn, Evercore (NYSE: EVR) reported a staggering Q4 2025 earnings beat this week, posting an adjusted earnings per share (EPS) of $5.13. The result, which blew past analyst estimates of $4.

Via MarketMinute · February 6, 2026

As of early February 2026, the long-predicted "Great Rotation" in the financial markets has moved from a theoretical forecast to a dominant reality. After years of a top-heavy market driven by a handful of technology titans, the tide has finally turned. The first five weeks of 2026 have seen the

Via MarketMinute · February 6, 2026

As of early February 2026, the global financial markets are witnessing a paradigm shift that many analysts are calling the "Security Supercycle." What began as a reactive surge in defense spending following the 2022 invasion of Ukraine has evolved into a structural, multi-decade rearmament phase. This "deterrence economy" has pushed

Via MarketMinute · February 6, 2026

As of February 6, 2026, the corporate landscape in London is being redefined not by ambitious mergers or technological breakthroughs, but by a massive, sustained return of capital to shareholders. Yesterday’s twin announcements from Shell (LSE: SHEL) and Vodafone (LSE: VOD)—confirming billions in fresh share buybacks—mark a

Via MarketMinute · February 6, 2026

In a staggering reversal that has stunned global commodity markets, gold prices have retreated sharply from their historic record highs, recording a massive 11% correction over the past week. The sell-off, which culminated in a violent "flash crash" on January 30, 2026, saw spot gold tumble from a peak of

Via MarketMinute · February 6, 2026

The paradox of the "front page of the internet" was on full display this week as Reddit, Inc. (NYSE: RDDT) reported fourth-quarter 2025 financial results that, on paper, should have sent shares soaring. The company delivered a significant beat on both top and bottom lines, fueled by a surge in

Via MarketMinute · February 6, 2026

As the dust settles on the 2025 holiday shopping season, Apple Inc. (NASDAQ:AAPL) has once again silenced skeptics with a blockbuster fiscal first-quarter report that underscores the company’s unparalleled market resilience. Defying fears of a saturated global smartphone market and geopolitical headwinds, the tech giant posted record-breaking revenue

Via MarketMinute · February 6, 2026

Uber Technologies (NYSE: UBER) reported its fourth-quarter and full-year 2025 earnings this week, unveiling a financial performance that underscores its absolute dominance in the global mobility and delivery sectors. While the company achieved record-breaking revenue and user growth, the market’s reaction remained lukewarm, as investors balanced impressive operational metrics

Via MarketMinute · February 6, 2026

In late January 2026, the artificial intelligence gold rush hit a structural wall of skepticism. Microsoft (Nasdaq: MSFT), the company that kicked off the generative AI era with its investment in OpenAI, reported a set of quarterly earnings that has left Wall Street divided. While the tech giant posted record

Via MarketMinute · February 6, 2026

In a dramatic shift for global equity markets, the first week of February 2026 has witnessed a sharp technical breakdown as long-standing momentum gauges for the S&P 500 (NYSE:SPY) turned negative. The bullish fervor that propelled the market to historic highs throughout 2025 has collided with a wall

Via MarketMinute · February 6, 2026

The global mergers and acquisitions (M&A) landscape has officially shifted from a period of high-rate hibernation to an era of "megadeal" dominance. On February 4, 2026, Evercore (NYSE:EVR) reported record-breaking fourth-quarter earnings that not only shattered analyst expectations but also served as a definitive bellwether for a broader

Via MarketMinute · February 6, 2026

The four-day partial government shutdown that began at midnight on January 30, 2026, has officially come to a close, yet the ripples of the gridlock continue to disturb the waters of Wall Street. While the signing of a short-term funding bill on February 3 restored operations for the Department of

Via MarketMinute · February 6, 2026

WASHINGTON, D.C. — In a week that has sent tremors through the global financial architecture, Treasury Secretary Scott Bessent appeared before the Senate Banking Committee on February 5, 2026, delivering testimony that many economists believe signals a fundamental shift in the relationship between the White House and the Federal Reserve.

Via MarketMinute · February 6, 2026

The nomination of Kevin Warsh to lead the Federal Reserve has ignited a firestorm in Washington, pitting the White House against a group of determined Republican senators and paralyzing the world’s most powerful central bank. As of February 6, 2026, the transition of power at the Fed—intended by

Via MarketMinute · February 6, 2026

The global race for obesity market dominance reached a historic turning point this week as Eli Lilly and Company (NYSE: LLY) officially crossed the $1 trillion market capitalization threshold, cementing its status as the world’s most valuable healthcare entity. The milestone follows a stellar 2026 guidance report that projected

Via MarketMinute · February 6, 2026

As the dust settles on the fourth-quarter earnings season of 2025, a clear divergence has emerged among the "Magnificent Seven" technology giants. While much of Silicon Valley is grappling with the staggering costs of the artificial intelligence arms race, Meta Platforms Inc. (NASDAQ: META) has defied the skeptics. By successfully

Via MarketMinute · February 6, 2026